Invoicing for goods

If we approve you to supply goods to an injured worker, you can invoice us online through My Provider Services or by mail or fax. The vendor invoice authorization letter you receive from us outlines specific invoicing requirements. Following these requirements will help us pay you sooner.

Before providing goods to the client, be sure you have our approval. We'll send it to you in a vendor invoice authorization letter. This letter gives the client’s details, a listing of the items and dollar amounts approved, and contact information for the vocational rehabilitation consultant who made the referral.

The fastest and easiest way to submit your invoices and supporting documents to us is through My Provider Services. You can also use this online portal to save draft invoices, attach additional documents to your invoice, get confirmation when we receive an invoice, and see status and payment details.

To get started, you’ll need to set up an account with us. To learn more, you can watch this short video on how to set up your account and access My Provider Services.

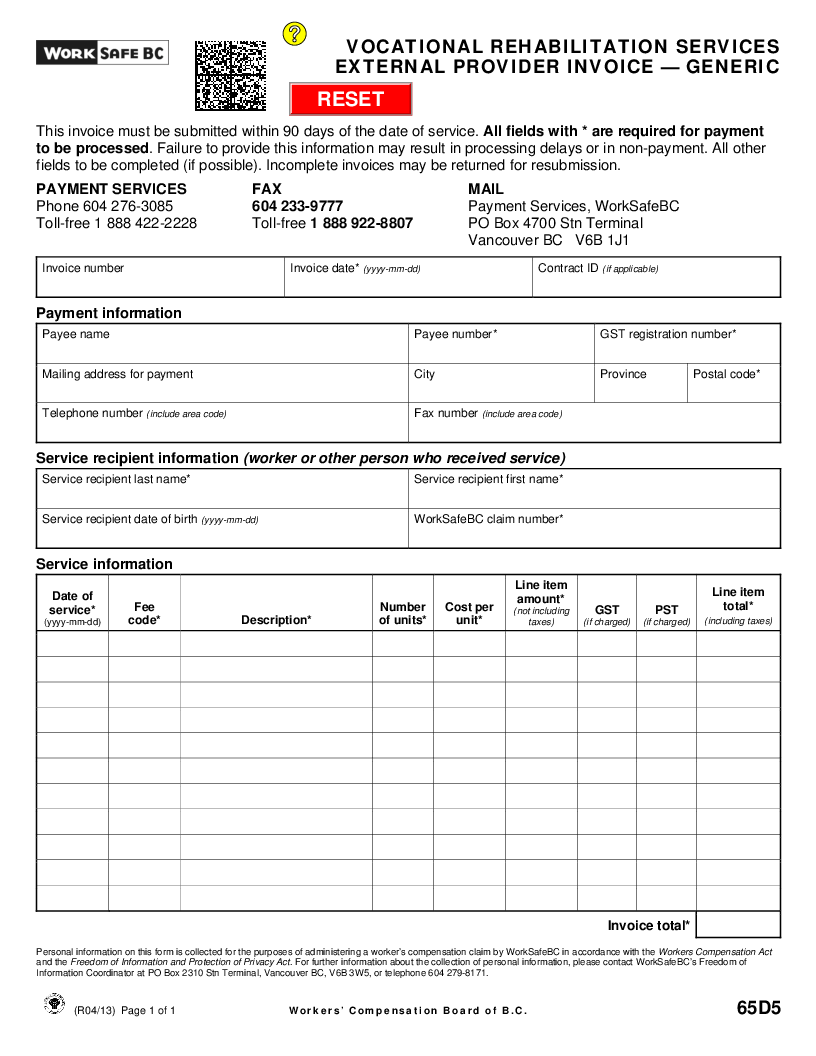

You also have the option to fax or mail your invoice to us. Our fax number and mailing address appear at the top of the invoice template.

Please submit your invoice within 90 days of service delivery. Contact our Payment Services team with any invoicing questions.

If you’re sending an invoice by fax or mail, we encourage you to use our Vocational Rehabilitation Services External Provider Invoice — Generic Form 65D5. All of its mandatory fields are marked with an asterisk. Please double-check that these fields are all filled in before you submit the invoice.

If you choose to use your own form, please clearly label the information. For example, the client's eight-digit claim number must be preceded with the label "Claim number," so that we know what it is.

To protect the privacy of clients, please submit a separate invoice for each client.

Be sure to include the following information on your invoices:

|

Information required |

Notes |

|---|---|

|

Invoice number |

This allows you to check the status of your invoice online |

|

Invoice date |

Make sure your invoice is not post-dated |

|

Payee number |

Your payee number, or vendor number is listed in the authorization letter we sent you |

|

GST registration number |

Only if applicable |

|

Postal code |

|

|

Worker’s name |

Name of service recipient |

|

Service information |

Notes |

|

Date of service |

For each item, indicate the date you supplied the item to the worker. This date must not be after the invoice date. |

|

Fee item description |

This is listed in the authorization letter we sent you |

|

Fee codes |

These are listed in the authorization letter we sent you |

|

Item amount |

The amount billed must not exceed the amount we approved in the authorization letter we sent you |

|

Taxes (GST and PST) |

Indicate next to each item if GST or PST applies. Indicate either the GST or PST amount for each item, or use an indicator such as a “G” for GST and a “P” for PST if it applies to the item. |