Short-term wage-loss benefits

We use a four-step process to calculate your wage-loss benefits. You can use our table to estimate your benefits for the first 10 weeks of your claim based on your earnings level. The actual amount you receive may be different due to your individual circumstances.

The wage-loss benefits formula

The wage-loss benefits you receive depend on your weekly wage rate and the days of the week you may work. This rate is the starting point in determining the payment we issue.

Our wage-rate calculation has four steps:

| Step 1: |

We start with your gross earnings at the time of your injury. We get this information from you and your employer(s). If you work a set schedule for an hourly wage, we will use this information to set your rate. If your earnings vary for any reason, we look at your three-month earnings to determine your average. With that information we're able to calculate your annual earnings. If you are self-employed and have Personal Optional Protection, we have separate information available. |

Your gross annual earnings |

| Step 2: |

We subtract your estimated federal and provincial income taxes from your gross earnings. We do that because your income taxes are your responsibility. We also subtract your estimated CPP contributions and EI premiums from your gross annual earnings. These are not payroll items that we cover or manage for you. |

- Federal/provincial taxes |

| Step 3: |

That leaves us with a calculated net earnings amount. It will be similar to your take-home pay from your employer. The coverage we provide is 90% of this amount, so you can multiply this figure by 90% to determine roughly how much you'll receive. |

= Your net annual earnings |

| Step 4: |

We divide that by 52.14, the exact number of weeks in a year, to get your weekly wage rate.This amount may not equal exactly 90% of your usual weekly take-home pay. For an explanation of what might account for the difference, check out our list of factors that affect wage-loss benefits. |

÷ 52.14 weeks |

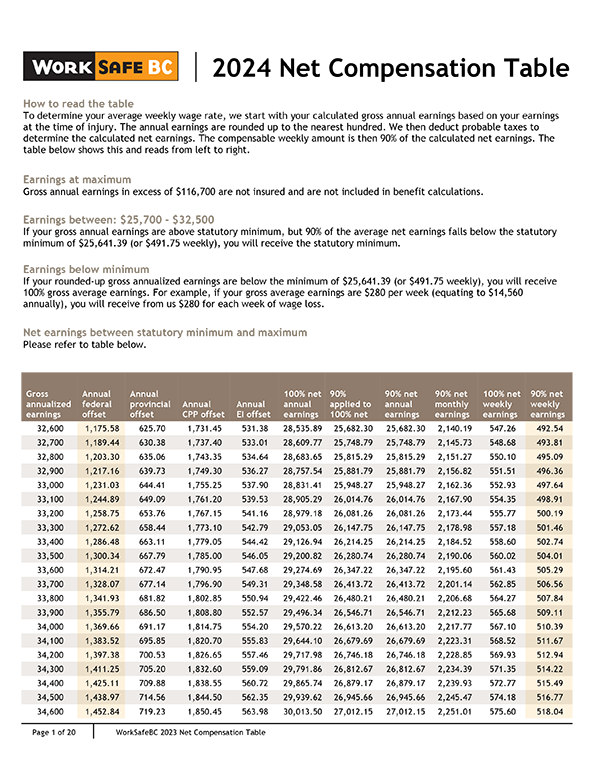

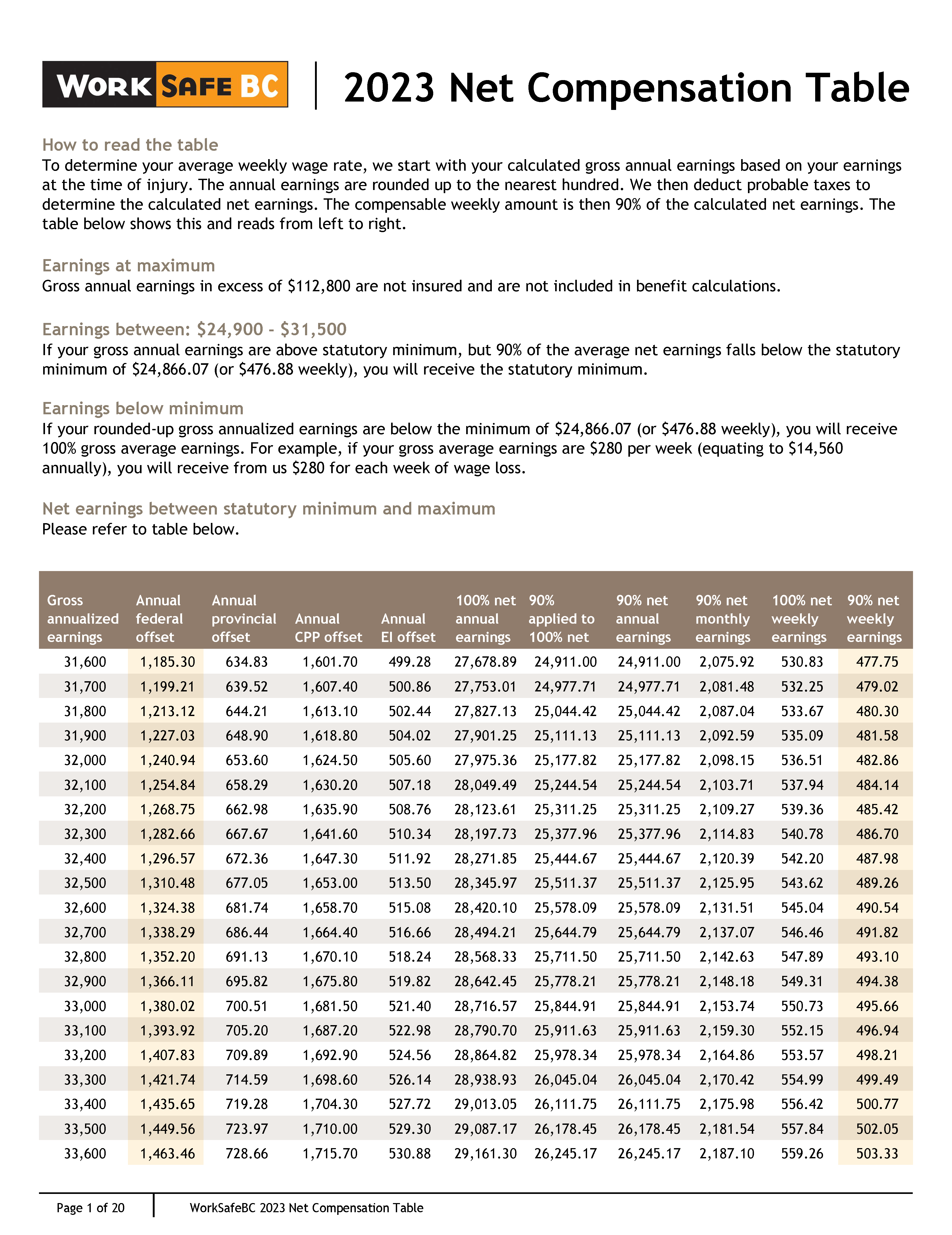

View 2024 NET compensation table.

To usethe table, find your gross annual earnings in the left-hand column. Round your earnings up to the nearest $100. If you're not sure of your earnings, ask your employer(s). Then look to the right-hand column, "90% net weekly." It shows you the approximate weekly wage rate for the first 10 weeks of your claim.

In rare cases, an injury or illness might keep you off work for more than 10 weeks. If that happens, we use a different formula to provide long-term compensation.

Please remember that this table provides an estimate only. Your actual benefits may differ. We'll send you a letter explaining how we’ve calculated the amount.